This page is the Cliffnotes version of all the best financial tools I have discovered as a professional money blogger over the last 15 years.

This means that you can save hundreds of hours of research and trial and error and get the shortcut to the best stuff out there.

No joke, I opened 34 credit cards to find the best one, have researched 50+ banks in search of the best, and have investigated countless apps to save myself (and our readers) as much time and money as possible.

Hopefully this helps you on your journey!

DISCLAIMER: I’m a Certified Educator in Personal Finance (CEPF®), but I am not your financial advisor, so do your own research! This article, the topics discussed, and ideas presented are Bob’s opinions and presented for entertainment purposes only. The information presented should not be construed as financial advice. Always do your own due diligence. Any references to interest rates, promotions, and websites are subject to change without notice. We do our best to keep the information current, but things are always changing so it may be different now than when it was first published. Additionally, this page may contain links that help us pay the bills by using affiliate relationships with Amazon, Google, eBay, and others, but our opinions are NEVER for sale. Find our more here.

This is one of my secret weapons. It’s called Rakuten (currently a $30 signup bonus too) and it is so simple and quick a 5-year old can do it and if you ever buy anything, you will save money.

Watch the 4-min video below to see exactly how it works.

💳 Credit Cards

Last we counted, we have received 161 hotel nights and 97 flights for FREE using credit card points and as a result, I am a big proponent of rewards cards.

Even though I have opened probably 25+ credit cards in the last 10 years, these are the best that I have found. That is why they are the only 2 in my wallet.

Running a financial blog, I hang out with many other nerds who love stuff like this, and almost everyone I know uses this card. Additionally, this card is consistently the top pick for travel rewards.

Simply put, when people ask me what the best all-around rewards credit card out there is, this is it. I have used this card as my primary card for 8 years now.

If you only want one card that pays fantastic travel rewards (or cashback if you prefer), this is the one I would recommend. Get all the details by clicking below.

This card is #2 for me.

It doesn't have all the perks and benefits of the Chase Sapphire Preferred® Card, but it does have 2 things going for it:

- No annual fee

- You earn 5% cash back on travel purchased through Chase Ultimate Rewards®, 3% cash back on drugstore purchases and dining and takeout at restaurants, and 1.5% on all other purchases.

I wrote about how this is the only card I use for my business here, so I won’t go into all the details again.

But, this card is insane in that it pays 3x points on the first $150,000 spent on purchases on travel, shipping purchases, Internet, cable and phone services, advertising purchases made with social media sites and search engines.

So if you have a business where you pay for any type of advertising (Facebook/Google ads, etc) definitely consider this one.

📱 Financial Tracking

This is currently my favorite way to track spending and monitor where every dollar is going.

You can see a full tutorial on how to use it here. If you want to get a big picture snapshot of your financial picture (without the Quicken nightmare), then it is worth checking out.

🏦 Banking

After researching 50+ banks, this has been our everyday bank for the last 5 years. I love this bank for a few reasons:

- They always have industry-leading interest rates in their savings accounts.

- They have eliminated overdraft fees.

- They have chat support, so you can get answers without having to call.

Additionally, we have found that they work better with our Real Money (un)Budgeting Method than any other bank we have found. Our runner-up is Capital One 360.

💵 Budgeting

After testing pretty much every budgeting app and software out there and still finding that we hated budgeting, we decided there had to be a better way.

So we developed an alternative to traditional budgeting that is easier, quicker, and simple enough for Linda to use. It’s called The Real Money Method.

To date, we have taught the method to nearly 2,000 students, and this is just a small sampling of this is just a small sampling of the testimonies and miracles that have resulted.

🗄️ Insurance

We have used Medi-Share as our health insurance alternative for the last 14 years. We found them to be way cheaper than traditional health insurance and we appreciate that our premiums aren't supporting practices and procedures that conflict with our beliefs.

You can check read our Medi-Share review here for all the details.

📈 Investing Apps

If you are a new investor wanting to get started, I highly recommend our 10x Investing course where I teach our students exactly how I have gotten 10x returns on my money over my last 16 years as an investor.

There are so many get-rich-quick schemes out there right now, and this course is the antithesis. Instead, it teaches proven and time-tested long-term investing strategies so you can invest wisely and have the best opportunity for long-term growth while reducing risk.

In the course, we cover all the strategies and tools I use, but here are a few to get you started:

This is one of my favorite money apps out there. Simply put, it is the easiest way to start investing with no money. They just round up all the purchases you make to the next dollar and invest the difference.

So, say you go to the grocery store and spend $16.25, they will round up to $17.00 and take the 75 cents and invest it. If you do that over and over, it quickly adds up to some big savings.

By far, the easiest set-it-and-forget-it way to get started investing. Here is how it works.

This is the easiest way to invest in real estate that I have found.

We actually sold our rental property shortly after realizing that our Fundrise returns (which are 100% passive by the way) beat our rental property returns.

Watch the video down below or click here to read my full Fundrise Review with all the details of this experiment I ran.

This is my favorite place for new investors to buy ETFs, stocks, and common cryptocurrency.

They are unique in that they do all 3 of these things (that very few online brokers do):

- They allow you to buy fractional shares. So if the stock price is at $200/share, but you only have $50 to invest, you can buy 1/4 of a share. Not many online brokers do this.

- They offer a ROTH IRA option – this is a must in my book.

- They have a super-simple user interface. I have accounts at 10-15 online brokers and Sofi is by far the easiest and simplest to use.

My runner up is Robinhood, but at this point they don’t offer a Roth IRA.

If you are wanting to see how you are doing at reaching your retirement goals, this is a goodie. I mentioned Empower up above for financial tracking, but they also have a free tool built in to help me see if I am on track for my retirement goals.

It is really helpful to see how increasing your savings amount by $50 a month can impact your retirement nest egg.

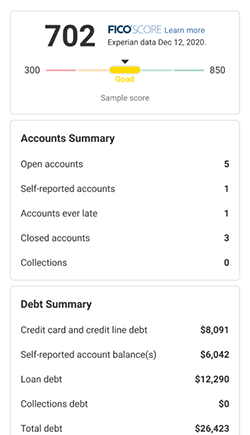

📝 Credit Reporting

Admittedly, I don’t use these much anymore since we paid off our debt, and since we don’t plan on borrowing ever again, I don’t really care what my credit score is.

I generally suggest checking them annually just to make sure there aren’t errors on there harming you.

These are the tools I used in the past and are the best (FREE) options I know of:

These guys will do about everything and for FREE:

- Check your credit reports (Transunion and Equifax)

- Check your credit score

- Monitor your credit report for you

What I love about them is that they monitor your credit report for you, just in case you forget to check it each year.

As you probably know, there are 3 different credit reports. Credit Karma only checks 2 of them, unfortunately.

So you can use this site to get the other one (Experian).

I’ll continue to update this post as I think of other money tools and money apps that we use and love.

Got any great ones you recommend?

Let me know in the comments!